Monitor

Advise

Influence

argon.africa

Snapshot

The Dangote–NUPENG dispute has escalated into a structural test for Nigeria's downstream petroleum sector.

Dangote's 4,000-truck CNG fleet challenges unionised tanker drivers and entrenched logistics models.

A government-brokered truce collapsed within 48 hours, exposing weak regulatory enforcement.

Dangote rejects marketers' alleged ₦1.5 trillion subsidy demand, framing it as rent-seeking.

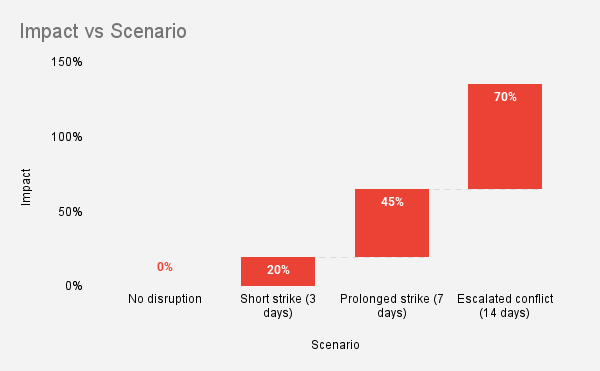

Argon estimates a 3-day strike could cut national fuel supply by 20%, while a 14-day escalation could curtail up to 70%.

With headline inflation at 20.12% (NBS, Aug 2025), Argon's Inflation Pulse shows protein-rich foods have surged over 250% in conflict zones, magnifying fuel shock risks.

Export buyers, financiers, and corporates face counterparty, FX, and reputational exposure if disruptions persist.

The collapse of the fragile truce between Dangote Refinery and the Nigeria Union of Petroleum and Natural Gas Workers (NUPENG) has reopened structural questions in Nigeria's downstream petroleum sector. What began as a dispute over union rights has escalated into a confrontation that underscores the complex interplay of private capital, organised labour, and state authority. For corporates, this standoff is not an isolated industrial spat but a signal of systemic risks shaping Nigeria's investment and operational landscape.

At the core of the conflict lies Dangote's decision to deploy 4,000 compressed natural gas (CNG) trucks to handle direct fuel distribution. Management has presented the strategy as cost-saving, environmentally friendly, and capable of creating more than 60,000 direct jobs. NUPENG, however, views the move as an exclusion of unionised tanker drivers and a violation of the constitutional right to freedom of association. The clash has already triggered nationwide strikes, fuel shortages, and blockades at refinery loading bays, while government mediation collapsed within 48 hours. NUPENG accused Dangote of coercing drivers to strip union insignia from trucks and of deploying security forces to disperse protests. Dangote has denied these claims, insisting that union membership remains voluntary and stressing the wider economic value of its investment.

The dispute has also spilled into pricing politics. According to Dangote Refinery, the Depot and Petroleum Products Marketers Association of Nigeria (DAPPMAN) is demanding an effective subsidy of ₦1.5 trillion annually to align depot prices with the refinery's gantry rates. The refinery claims this demand, based on daily national consumption of 40 million litres of petrol and 15 million litres of diesel, effectively reinstates subsidy-era distortions. Dangote argues that agreeing to absorb or offset such costs would burden the economy, undermine logistics reform, and repeat the fiscal inefficiencies that long characterised Nigeria's fuel markets.

Argon's scenario analysis, complemented by the market trends explored in the Argon Inflation Pulse (August 2025), projects the following outcomes:

The implications of both the labour and pricing disputes are profound. Argon.Africa analysis shows that a three-day strike could cut national fuel availability by around 20 percent, while a two-week escalation could curtail up to 70 percent. In a context where headline inflation stood at 20.12 percent in August 2025 (NBS), Argon's Inflation Pulse highlights that while staple prices such as rice and maize have declined by as much as 27 percent this year, protein-rich foods like fish, eggs, and tomatoes have soared by more than 250 percent in conflict-affected regions. Any shock to fuel supply would cascade into higher transport and food costs, worsening the inflation paradox of macro stability without household relief.

The international dimension is equally significant. Dangote's first gasoline cargoes to Europe and the United States have raised Nigeria's global energy profile, but foreign buyers and financiers will closely monitor reliability and political risk. The inability of Nigerian authorities to enforce agreements further raises concerns over regulatory certainty, while reputational risks around "anti-labour practices" could feed domestic populism.

Argon.Africa assesses that the conflict is structural and unlikely to be fully resolved in the short term. Labour resistance to logistics innovation and entrenched distribution interests mean intermittent disruptions will persist over the next 6–12 months. For corporates, the strategic implications are clear: energy firms must build contingency plans for supply bottlenecks; marketers and traders should diversify sourcing; financiers need to monitor FX flows and liquidity shocks; logistics operators should prepare for opportunities in CNG partnerships while mitigating transition risks; and manufacturers as well as transport operators must plan for fuel-linked volatility.

Similar Insights:

Loading similar insights...