Monitor

Advise

Influence

argon.africa

Oil prices fell on Monday, July 7, 2025, after OPEC+ announced a larger-than-expected production increase of 548,000 barrels per day (bpd) for August. Brent crude slid to $68.06 per barrel, $5 below Nigeria's 2025 budget benchmark of $73. For an oil-dependent economy already under pressure, this development presents significant fiscal and macroeconomic risks.

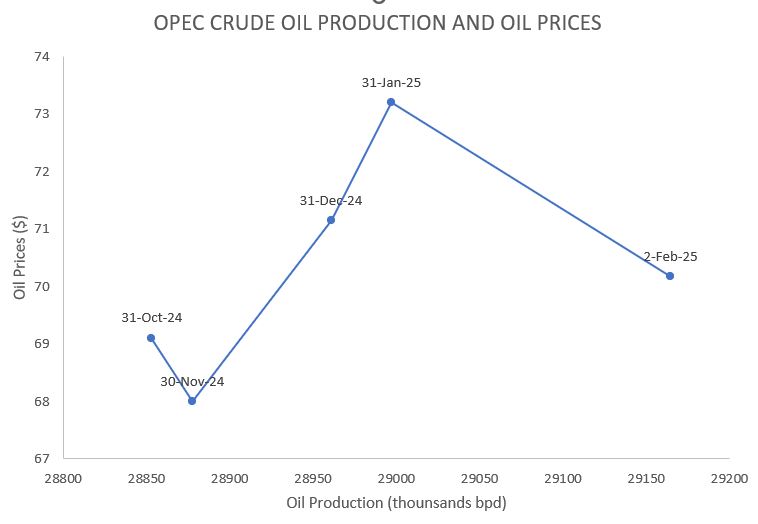

Source: Opec website

The output hike, which reverses much of the 2.2 million bpd in voluntary cuts made earlier this year, suggests growing competition within the cartel. Saudi Arabia is leading the charge, while most African producers are struggling to meet current quotas. Nigeria, producing just 1.3 million bpd in June, remains well below its allocation due to years of underinvestment, crude theft, and poor infrastructure.

The immediate concern lies in the widening fiscal gap. With oil revenues accounting for over 60% of government income and 90% of foreign exchange, a prolonged price dip could weaken the naira, disrupt budget implementation, and complicate debt servicing. According to Financial Derivatives Company Limited (FDC), such price pressures could stall key reforms, including downstream deregulation.

The Dangote Refinery could help mitigate external shocks by reducing reliance on imported fuel. However, delays in scaling production or issues in crude sourcing, highlighted in FMDQ commentary, could limit its impact. Meanwhile, businesses across sectors may face tighter FX conditions, costlier imports, and rising inflation.

Geopolitical tensions are adding to the uncertainty. U.S. President Donald Trump recently introduced new tariffs, including a 10% duty on countries supporting BRICS policies, labeling them "anti-American." Nigeria, already hit with a 14% export tariff, now faces further pressure on trade and investment flows. Some tariff rates could rise as high as 70%, further dampening global trade and oil demand.

Other African oil producers, such as Angola, Congo, and Gabon, also face declining output from aging fields and limited investment. With oil prices softening, many of their reform strategies may require urgent revision.

Argon's Way Forward

Nigeria risks losing out on OPEC+ gains due to persistent issues like oil theft, weak regulation, and poor infrastructure. The government must fast-track pipeline security, enforce upstream transparency, and fully implement the Petroleum Industry Act. Strong coordination between the CBN, Finance Ministry, and NNPC Ltd is essential to manage forex, stabilize the naira, and protect fiscal priorities.

Oil companies and refiners should prioritize cost efficiency, risk management, and resilient logistics. For the Dangote Refinery, securing stable crude supply and reliable operations is vital to reduce exposure to global disruptions and support local fuel stability.

Despite falling global oil prices, Nigerians may not see cheaper fuel due to forex constraints and import reliance. If the naira weakens, fuel and transport costs could remain high. Households should use energy wisely, plan spending carefully, and look to government support where needed to weather possible inflation and economic strain.

Similar Insights:

Loading similar insights...